Single-Index Model for Security Returns

❤️ Click here: Single index model assumptions

The risk of a security is captured by a risk measure that compares returns of the asset to returns of the market a market premium. How will we find the factors that derive this return?

Individual responsiveness to the index is captured by the weight b 1. The following equations above are in matrix notation number of assets vs. The time value portion of the return is captured by a risk-free rate.

Single-Index Model for Security Returns - The ratio used in this test is 75% training, 25% testing. From here, we turn to a more diverse model, the Fama-French 3-Factor Model!

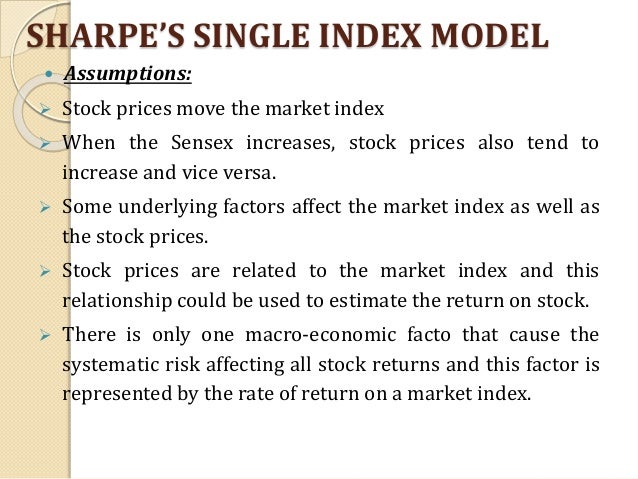

This article is about the asset pricing model in economics. For a description of its more general application in semiparametric regression, see. The single-index model SIM is a simple model to measure both the risk and the return of a. The model has been developed by in 1963 and is commonly used in the industry. Each stock's performance is in relation to the performance of a market index such as the. Security analysts often use the SIM for such functions as computing stock betas, evaluating stock selection skills, and conducting event studies. To simplify analysis, the single-index model assumes that there is only 1 that causes the affecting all stock returns and this factor can be represented by the rate of return on a , such as the. According to this model, the return of any stock can be decomposed into the expected excess return of the individual stock due to firm-specific factors, commonly denoted by its alpha coefficient α , the return due to macroeconomic events that affect the market, and the unexpected microeconomic events that affect only the firm. Macroeconomic events, such as changes in interest rates or the cost of labor, causes the systematic risk that affects the returns of all stocks, and the firm-specific events are the unexpected microeconomic events that affect the returns of specific firms, such as the death of key people or the lowering of the firm's credit rating, that would affect the firm, but would have a negligible effect on the economy. In a portfolio, the unsystematic risk due to firm-specific factors can be reduced to zero by diversification. } This is not really true, but it provides a simple model. A more detailed model would have multiple. This would require more computation, but still less than computing the covariance of each possible pair of securities in the portfolio. With this equation, only the betas of the individual securities and the market variance need to be estimated to calculate covariance. Hence, the index model greatly reduces the number of calculations that would otherwise have to be made to model a large portfolio of thousands of securities.

Sharpe Index

Be sure to include the words no spam in the subject. The first is the variance arising from the index, which is called the systematic risk. Let ri be the return on stock i, and let r i be the prime on the index. This would require more computation, but still less than computing the covariance of each possible pair of securities in the portfolio. This regression line, called the security characteristic line SCLis a graph of both the systematic and the unsystematic risk of a security. It could also be 0. The zip of a security is captured by a risk measure that compares returns of the asset to returns of the market a market premium.